5 Easy Facts About Estate Planning Attorney Described

5 Easy Facts About Estate Planning Attorney Described

Blog Article

How Estate Planning Attorney can Save You Time, Stress, and Money.

Table of ContentsNot known Details About Estate Planning Attorney The Definitive Guide for Estate Planning AttorneyNot known Incorrect Statements About Estate Planning Attorney Rumored Buzz on Estate Planning Attorney

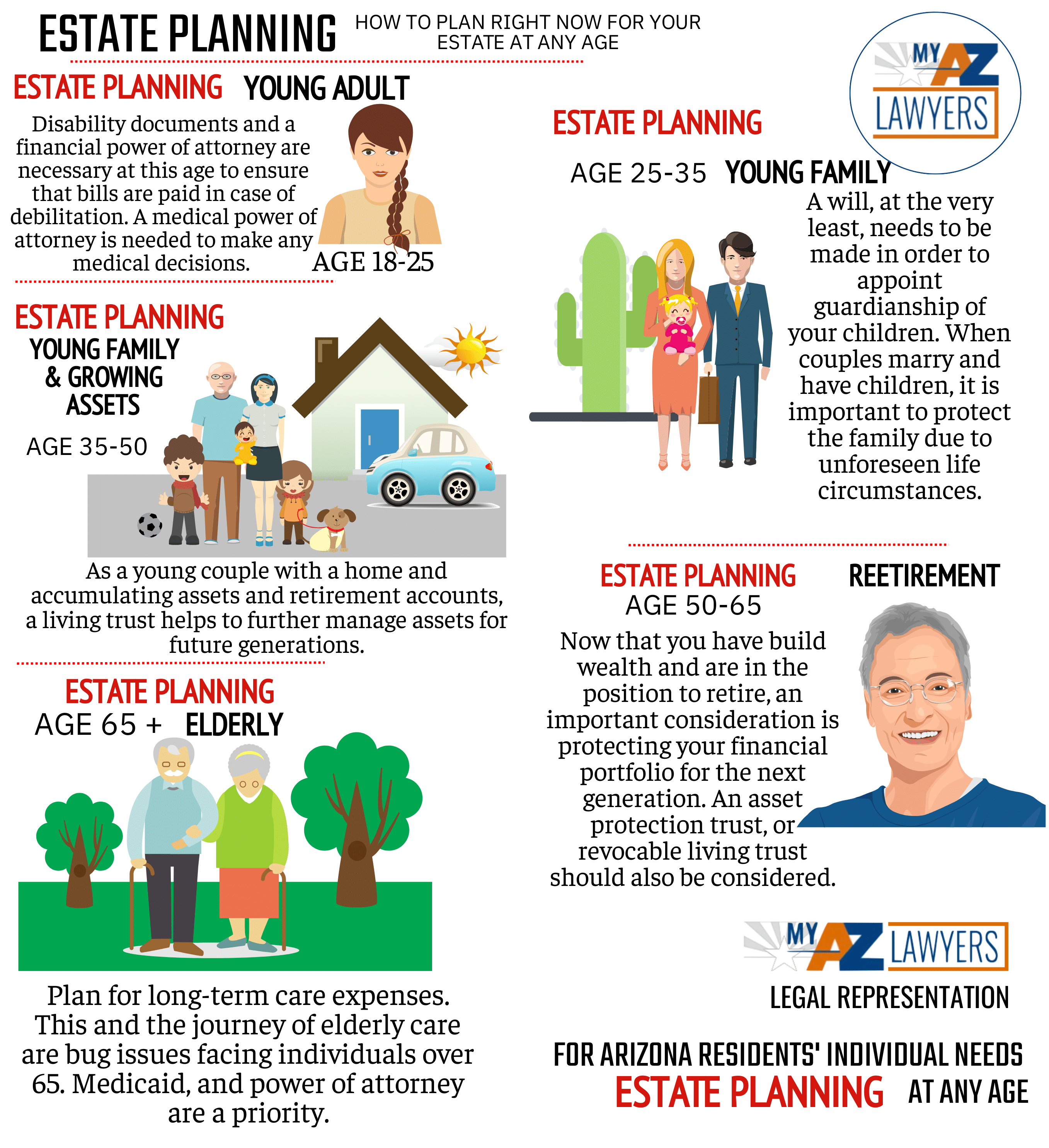

Estate planning is an action plan you can use to identify what occurs to your possessions and commitments while you're active and after you pass away. A will, on the other hand, is a legal document that describes how assets are distributed, who looks after youngsters and pets, and any other dreams after you pass away.

Cases that are declined by the executor can be taken to court where a probate judge will certainly have the last say as to whether or not the claim is valid.

The Ultimate Guide To Estate Planning Attorney

After the inventory of the estate has been taken, the worth of properties computed, and tax obligations and financial obligation settled, the executor will after that look for permission from the court to distribute whatever is left of the estate to the beneficiaries. Any kind of inheritance tax that are pending will come due within nine months of the date of fatality.

Each private locations their possessions in the count on and names someone various other than their partner as the beneficiary., to sustain grandchildrens' education and learning.

Getting The Estate Planning Attorney To Work

This technique entails freezing the value of a possession at its worth on the day of transfer. Accordingly, the amount of prospective resources gain at death is likewise frozen, permitting the estate planner to estimate their prospective tax obligation responsibility upon death and much better strategy for the payment of income taxes.

If adequate insurance policy proceeds are offered and the policies are effectively structured, any earnings tax obligation on the regarded dispositions of assets complying with the fatality of a person can be paid without resorting to the sale of assets. Earnings from life insurance policy that are obtained by the beneficiaries upon the death of the insured are typically earnings tax-free.

Various other fees connected with estate preparation consist of the prep work of a will, which can be as reduced as a couple of hundred bucks if you use among the finest online will certainly manufacturers. There are particular papers you'll require as part of the estate preparation procedure - Estate Planning Attorney. A few of one of the most common ones consist of wills, powers of lawyer (POAs), guardianship Visit Website designations, and living wills.

There is a misconception that estate planning is only for high-net-worth people. That's not true. Estate preparation is a device that everyone can use. Estate intending makes it much easier for individuals to determine their dreams before and after they die. In contrast to what most individuals think, it prolongs beyond what to do with properties and obligations.

10 Simple Techniques For Estate Planning Attorney

You should start preparing for your estate as quickly as you have any type of quantifiable asset base. It's a recurring process: as life advances, your estate strategy need to shift to match your scenarios, in line with your new objectives. And maintain at it. Refraining from doing your estate preparation can cause unnecessary economic concerns to enjoyed ones.

Estate preparation is site web usually assumed website here of as a device for the affluent. Estate preparation is likewise an excellent method for you to lay out plans for the care of your minor children and pet dogs and to detail your desires for your funeral and preferred charities.

Eligible applicants who pass the test will be officially accredited in August. If you're qualified to rest for the test from a previous application, you may file the brief application.

Report this page